-

Services

-

expand_more

Back

Services

-

-

expand_more

Back

Rates & Property

- Setting the Rates

- Revaluation and how it affects rates

- Rates Dates & Payment Options

- Changing your details

- Property Information Search

- Online Rates Payments

- Rates Rebates, Remission & Postponement

- Short-Term Visitor Accommodation

- Queenstown CBD Transport Rate for Queenstown Town Centre Properties

- Wastewater Rates for Cardrona

- Other Information

- Rates FAQs

-

-

expand_more

Back

Rubbish & Recycling

- How we recycle in the Queenstown Lakes District

- Cut your waste

- Commercial Services

- Public place litter bins and illegal dumping

- Rubbish & Recycling Collection

- Recycling Centres

- Transfer Stations

- Solid Waste Assessment

- Waste Minimisation Community Fund

- Waste Minimisation for Businesses

- Zero Waste Events

- Green and food waste

- Construction and demolition waste

-

-

expand_more

Back

Resource Consents

- Do I need a resource consent?

- Change, extend or surrender a resource consent

- Before you apply

- Apply for a resource consent

- Non-compliance & monitoring

- Notified consents

- Land Developments and Subdivisions

- Need help?

- Current resource consents

- eDocs

- FAQs

- Practice notes and guidance

-

-

expand_more

Back

Alcohol Licensing

- Alcohol Public Notices

- Find the right alcohol licence and apply

- Alcohol licence fee calculator

- Renew and/or vary your alcohol licence

- Manager's certificates

- Legal requirements for licence holders

- District Licensing Committee decisions

- ARLA annual report

- Alcohol-Free Areas In Public Places

- Have your say on alcohol licence applications

- All alcohol licensing forms

- Gambling Information

-

-

Do It Online

-

expand_more

Back

Do It Online

-

-

expand_more

Back

Registrations

- Register your Dog

- Register for a transfer or refund of dog registration fee

- Renewal for Campgrounds and Offensive Trade Registrations

- Activities in a Public Place - Registration/Application Form

- Register as a Homestay

- Register as Residential Visitor Accommodation

- Register for our public notification list

- Register to speak at Public Forum

- Register for Kerbside Collection Services

- No Spray Register

-

Community

Community

Ngā Hapori

- Manaaki

- Newcomers Guide

- Welcoming Communities

- Arts, Culture and Heritage

- Community Connect

- Citizenship Ceremonies

- Community Associations and Groups

- Community Funding

- Community Research

- Community Wellbeing

- Economic Development

- Emergency Management

- Energy Saving Tips

- Event Planning and Venues

- Māori Community

- Managing the risk of wildfire

- Population and Demand

- Summerdaze

- Tuia Programme

- Venue Hire

2025 Quality of Life Survey

Our annual survey is now open and your views are important!

-

Recreation

Recreation

Kā mahi a te rēhia

- Queenstown Events Centre

- Wānaka Recreation Centre

- Paetara Aspiring Central

- Swim

- Learn to Swim

- Golf

- Kids' Recreation

- Sport & Rec Venues and Contacts

- Courts and Fields

- Memberships - Join Today

- Join the Sport & Rec Team

- Responsible Camping

- Parks and Walkways

- Lakes and Boating

- Mountain Biking

- Horse Riding

- Splash Café

- Physiotherapy

- Playgrounds

- School Holiday Programmes

- This Is Sport & Recreation

Bow & Arrow

A fitness programme in Arrowtown featuring strength and stretch elements. Book your spot now!

-

Your Council

Your Council

Te Kaunihera ā-rohe

- News

- Newsletter Archive

- Careers

- Consultations

- Council Documents

- Council Meetings

- Council Projects

- User Fees and Charges

- Climate Change and Biodiversity

- District Plan

- Elected Members

- Elections

- Media Centre

- Our Strategic Framework

- LGOIMA (information) requests

- Public Notices

- Sister Cities

- Fast-track Approvals Act

Climate & Biodiversity Plan

Read our latest plan which was adopted by Full Council on Thursday 31 July 2025.

-

expand_more

Back

Your Council

-

-

expand_more

Back

Council Documents

- Long Term Plan (LTP)

- Archived Agendas & Minutes

- Annual Plans

- Annual Reports

- Asset Management Plans

- Awarded Council Contracts

- Bylaws

- Capex Quarterly Update

- Monthly Reports

- National Policy Statement - Urban Development 2020 (NPS-UD)

- Policies

- Pre-election reports

- Queenstown Lakes Spatial Plan

- Reserve Management Plans

- Section 10A Reports

- Small Community Plans

- Strategies and Publications

- Submissions from QLDC

-

-

expand_more

Back

Council Projects

- Project Tohu

- Queenstown Town Centre Arterial

- McPhee Park Playground

- Blue-Green Network Plan

- Frankton Track Wastewater Upgrades

- Aubrey Road Wastewater Pipe Upgrades

- Luggate Water Upgrades

- Kingston Infrastructure Works

- Queenstown Town Centre Street Upgrades

- Way To Go

- Our Water Done Well

- Upper Clutha Wastewater Conveyance Scheme

- Shotover Wastewater Treatment Plant Stage 3 upgrades

- Short term approach for managing wastewater discharge

- Long term solution for Shotover Wastewater Treatment Plant

- Smart Water Meters Trial

- Environmental Monitoring System

- Lakeview Development

- Mount Iron Reserve Management Plan

- Project Manawa

- Wānaka Airport Certification

- Wānaka Airport Future Review

- Improving housing outcomes

- Queenstown Lakes Home Strategy

- Upgraded Two Mile UV Treatment Plant

- Frankton Road Watermain Upgrades

- Glenorchy Water Treatment Upgrades

- Upper Clutha Safety Improvements Programme

- Cardrona Valley Water Supply Scheme

- Schools to pool active travel route

- All-weather turf at Queenstown Events Centre

- Arthurs Point to Queenstown shared path

- 101 Ballantyne Road Masterplan

- Ballantyne Road Upgrade

- Cardrona Valley Wastewater Upgrade

- Glenorchy Reservoirs

- Frankton Campground

- Frankton Stormwater Upgrade

- Marine Parade Upgrades

- Mayoral Housing Affordability Taskforce

- Shotover Country Borefield and Treatment Plant

- Proposed Visitor Levy

- Ladies Mile Masterplan

- Recreation Ground Wastewater Pump Station and Rising Main

- Luggate Memorial Centre

- Te Kararo Queenstown Gardens

- Western Wānaka Water Supply Upgrade

- Shotover Bridge Water and Wastewater Main

- Te Tapuae Southern Corridor

- Glenorchy Marina Carpark

- Wānaka Lakefront Development Plan

- Travel Demand Management Programme

- Peninsula Bay Reserve Regeneration

- Merton Park Playground

-

-

expand_more

Back

District Plan

- Operative District Plan

- Proposed District Plan

- ePlans

- National Policy Statement-Urban Development (District Plan Amendments)

- Urban Intensification Variation

- Te Pūtahi Ladies Mile Variation

- Private Plan Change 1 - The Hills Resort Zone

- Upper Clutha Landscape Schedules Variation

- Priority Area Landscape Schedules

- Special Zones Review

- District Plan Maps

- A Guide to Plan Changes

- Planning Matters - Planning & Development Newsletter

- Services

- Rates & Property

- Rubbish & Recycling

- Building Services

- Resource Consents

- Environmental Health

- Transport and Parking

- Alcohol Licensing

- Animal Control

- Airports

- Environment and Sustainability

- Water Services

- Cemeteries

- Services A - Z

- Summer Services

- CCTV - Public Use

- Permits

Development contributions

Utu whakawhanake

A development contribution is a financial charge levied on new developments to ensure that any party who creates additional demand on local infrastructure contributes to the extra cost they impose on the community. It is assessed and collected under the LGA 2002.

Quick links

Latest Development Contribution Policy

The Local Government Act 2002 allows Council to update the policy annually (ahead of the LTP process) to account for annual inflation, in line with the Producers Price Index (PPI) outputs for construction. The annual change between September 2023 and September 2024 was 2.4%. This has been used as a proxy for one year’s inflation as it is the latest data available at the time this work was prepared.

Click on the link below for the changes to Development Contributions for 2025-2026, following the annual policy update.

Past Development Contribution Policy

2021-2031 Long Term Plan

What do they relate to?

Development contributions relate to the provision of the following council services:

-

Water supply.

-

Wastewater supply.

-

Stormwater supply.

-

Reserves, Reserve Improvements and Community Facilities.

-

Transportation (also known as Roading).

When is a development contribution triggered?

A Development Contribution is triggered by:

-

the granting of a Resource Consent,

-

the issue of a Building Consent, or

-

the receipt of an application for a Utility Service Connection.

What costs are involved?

All estimates undertaken by a Development Contribution Officer will be subject to fees. The extent of cost will be relative to the complexity and time taken to perform the assessment.

When do development contributions need to be paid?

-

Payment is due upon the granting of a land use consent. Where a Building consent is also required payment is due prior to the issue of the code of compliance certificate or prior to the connection to Council services, whichever comes first.

Close -

Payment is due prior to the issue of the section 224c certificate or prior to the connection to Council services, whichever comes first.

Close -

Payment is due prior to the issue of the Code Compliance Certificate or prior to the connection to Council services, whichever comes first.

Close -

Payment is due prior to the issue of the Utility service connection approval.

Close

How are development contributions assessed?

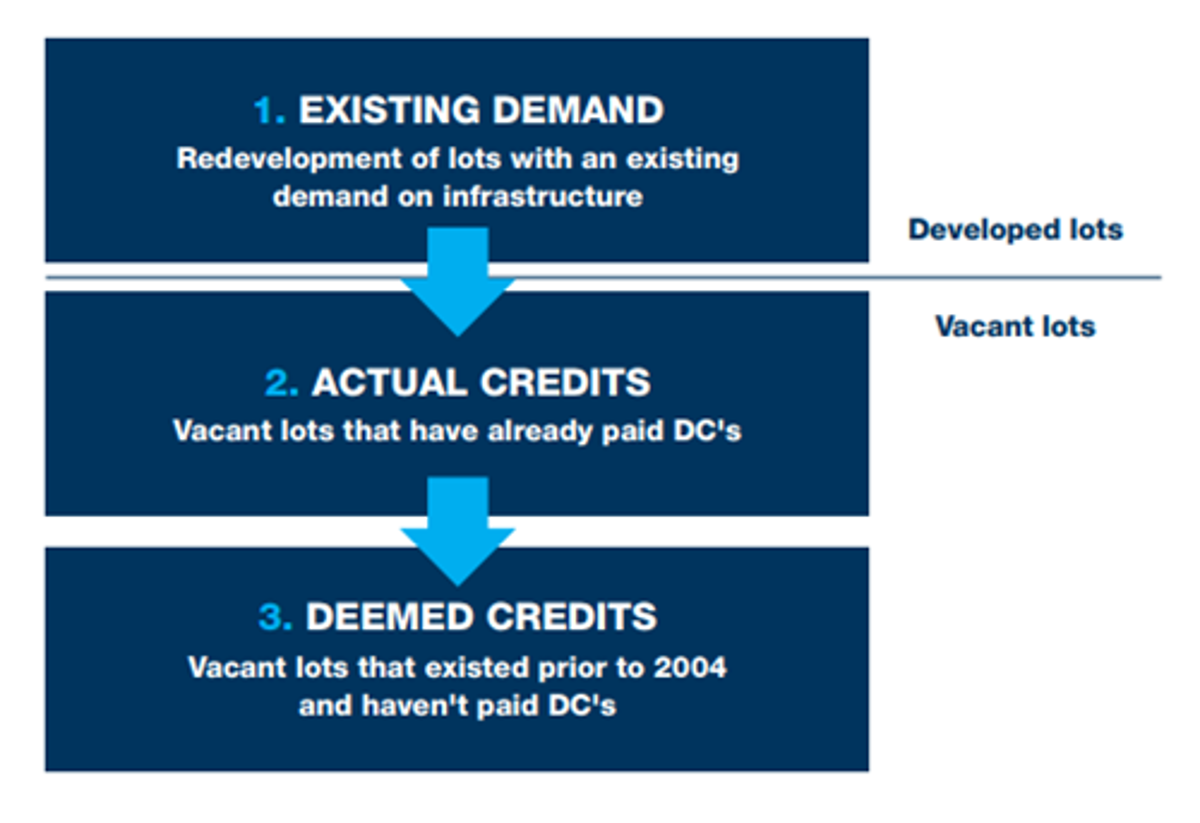

The following existing demand and credit considerations apply to all assessments:

-

The existing demand of any lot that is to be developed will be converted to a dwelling equivalent credit when assessing development contributions. Thus, development contributions are solely for additional demand created by the new development.

-

Credits will be specific to the activity for which they were paid (i.e. a water supply credit will not be able to offset a wastewater contribution).

-

Credits are to be site specific (not transferable) and non-refundable unless the refund provisions of the Act apply.

There are three types of development contribution credits that may be applied:

Can development contributions be reconsidered?

You can request for your development contribution requirement to be reconsidered if you have grounds to believe that:

-

the development contribution was incorrectly calculated or assessed under our Development contributions policy; or

-

Council incorrectly applied its Development contributions policy; or

-

the information used to assess the person’s development against the Development contributions policy, or the way Council has recorded or used it when requiring a development contribution, was incomplete or contained errors.

A request for reconsideration must be made in writing stating clearly on which grounds the applicant believes the Council has erred. The request for reconsideration must be made within 10 working days after the date on which the person lodging the request receives notice from Council of the level of development contribution that Council requires. To do this, please complete the request for reconsideration online form and include relevant documents.

The steps that Council will apply when reconsidering the requirement to make a development contribution are:

-

The appropriate Council officer shall review the reconsideration request.

-

The Council officer may request further relevant information from the applicant.

-

The Council officer will make a recommendation to the delegated authority.

-

Council will, within 15 working days after the date on which it receives all required relevant information relating to a request, give written notice of the outcome of its reconsideration to the person who made the request.

A reconsideration cannot be requested if the applicant has already lodged an objection. If the applicant is not satisfied with the outcome of the reconsideration, they may lodge an objection as specified in the Local Government Act 2002 Amendment Act (No 3) 2014, s199C to s199N.

Related Content

Stay up-to-date

Sign up to our newsletters and stay up-to-date with the latest news, events & information in the Queenstown Lakes District.